We would like to present to you a case study where we took a client from £0 to a staggering £1.6m in sales in an eight month timeframe!

Now, this case study is very technical. It will require you have some knowledge of Facebook and Instagram ads as it’s goes into detail about some pretty complex subjects around exactly how we executed the scale.

We know a lot about media buying here at Upbeat Agency and this case study demonstrates our ability to quickly scale on the most advanced advertising network in the world.

Get clear on the numbers

Targeting and audience sizing

Creatives & website changes

Scaling into Feeds and Stories

The actual scale

Scaling considerations

Lifetime Budgets Vs Daily Budgets

Manual bids and bid tests

Highlighted Results

Ad spend went from £50 a day to £17k a day

Shopify revenue hit a record high of 35k a day

£1.6 m in Shopify revenue

80 million impressions in the UK

Product offering went viral

Created a household brand name

Client Overview

The product also solves a common problem which presented a nice angle for the overall strategy.

The product had previous media coverage and that was to our benefit as we planned to use it as a social proof. This media coverage format was suitable for social media so we could incorporate it in our prospecting video creatives.

Getting clear on the numbers

Having a clear idea of the numbers is one of the most crucial steps in any campaign. Unfortunately a lot of businesses aren’t super clear on their numbers, as was the case here, so we needed to ensure we could help the client find a business model that was able to scale.

The financial model that we created involved;

Cost of Goods Sold (COGS)

Fulfilment costs

Shipping costs

Warehousing costs

Ad spend costs

VAT and tax

Merchant and other fees

Product price point

It is also imperative for the business owner to have a clear understanding of their numbers as if they don’t they might be in a negative cashflow when they are thinking they are in positive one.

The client was looking specifically for purchases putting reach, awareness and other marketing objectives not as critical. A CPA target of around £12 made financial sense and we set that as an initial goal.

Website Changes

We added customer product reviews. Reviews as a great way to show social proof. ‘’If other people are doing it, it must be good’’ The more social proof the better.

Proper product descriptions and more content on the landing and product page to combat bounce rate and increase website relevancy.

Since 90%+ of the traffic will come from mobile we tried to be more space efficient.

Video Ad Creatives

There is no doubt to scale to this level of volume you need to have video ad creatives. This will give you much better CPM’s and CPC’s and really allow you to open up the campaigns.

Given the high spend and quick reach we were improving the creatives and were constantly refreshing them when necessary to avoid the constant ad fatigue. For large scale campaigns we always want to have minimum of 5 different successful creatives (could be a mixture of videos, pictures, carousels, stories, etc) running at the same time and in many cases, we might have 20-30 different prospecting videos. In this particular case we had around 10 video creatives running at the same time.

We prepared different creatives and we started testing them to find initial indications of success. What we are looking for initially is high engagement mostly in the form of shares and comments as well as good CTR (All), CTR(Click) and if people are going into the funnel – ATC and Initiate checkout! We were looking for minimum of 3% CTR(all), 1.5% CTR(link) and a CPC less than £1. If we have these in place, we know we are close.

Targeting

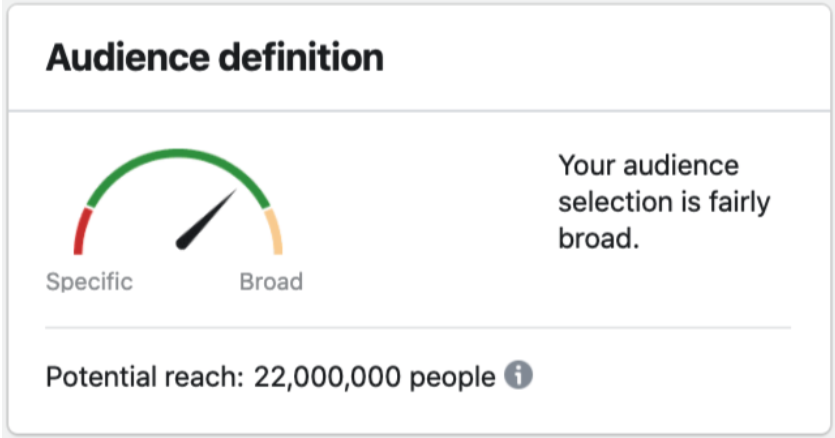

Most advertisers make the mistake of having a really narrowed down and small audiences which may produce some results but will not allow scale. We on other hand aim to have as broad audience as we can especially once we have more then 1000 purchases on the pixel then we try LLA up to 10% and may even have only age and gender broad targeting.

Once we had more then 1000 purchase pixel fires then if the aim is to scale to £10k+ a day in ad spend, we aim to have an audience larger than 10 million so we can scale sustainably. With an average CPMs in the UK we would have 1 million reach a day on £10k a day spend which is why larger audience is a necessity!

Our overall targeting was a mixture of the below:

- Interest based targeting to begin and warm up the pixel and get enough data (min 1000 purchase pixel fires) for good LLA source audience.

- LLAs from purchases – 1-10% and we do not exclude one from another as there is a difference between audience overlap and auction overlap which you will learn later in this case study.

- We also created LLAs from existing customers and run them at the same time as the above LLAs.

- Broad targeting splitting only into age and gender and only once we have a warm account, + 000 purchases ideally in the last 30 days.

- Separating Feed from Stories (starting with feed) so we can later on scale further into stories.

- Retargeting of the different steps of the funnel like engagers, traffic, VC, ATC and IC.

- Constantly restaging, rebuilding, previous ad sets as the pixel, account and LLAs get smarter.

The Secret of Lookalike Audiences

Most advertisers start LLAs too soon. What needs to be kept in mind is that Facebook takes a minimum of 5000 data points when targeting. Some advertisers build a LLA from 100 purchases and these audiences usually perform worse than an interest based targeting as its source audience is simply too weak and if it works in most cases it is because of the inventory pool the ads set landed in rather than the strength of the particular LLA used.

Then we further scale into Initiate Checkout LLA audience. Yes, you read that right. The first LLAs we start are the purchase ones and later on we scale into the others. The reason is not that the strength of the IC is more than the purchase LLA but it is that we, at this point are looking for a pool not so much for an audience.

Each audience whether that’s an interest based or an LLA is separated into smaller segments which we call inventory pools. At some point where the pixel is so smart it doesn’t really need so much guidance (targeting an audience) in terms of LLA or interest (even narrowed down) but it needs to land into ‘’a buyers’’ inventory pool rather than clickers or ATC inventory pool.

Now, knowing the above, we started a purchase LLA once we got a 1000+ registered sales and then we scaled, for the reasons explained above, into IC LLA, ATC LLAs, VC LLAs, traffic LLAs, engagers LLAs. We did this again simply to land into a different pool and to keep the ad sets auction overlap as minimum as possible, thus different ad sets with slightly different targeting (LLAs).

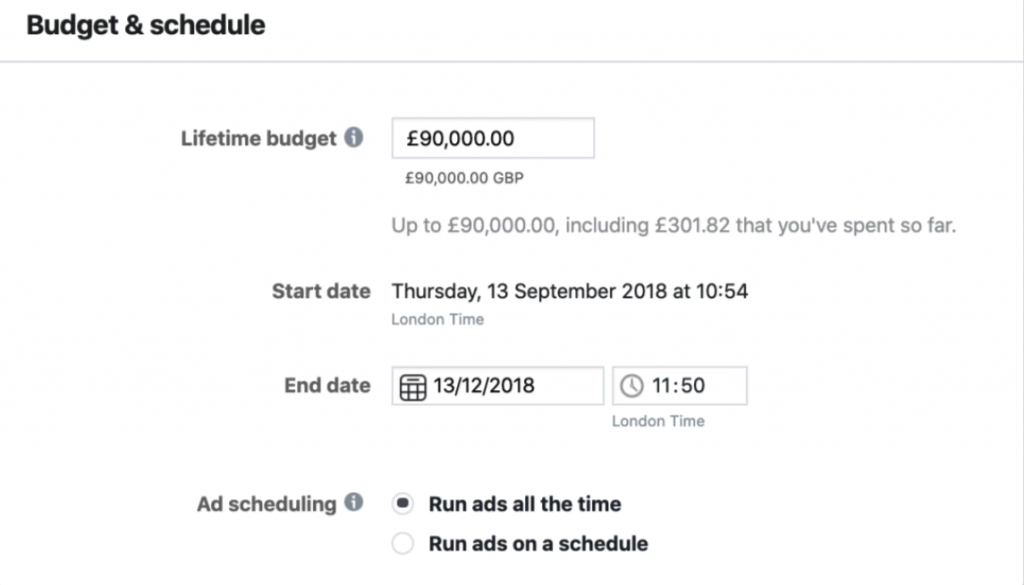

Mixing lifetime budgets with daily budgets

Facebook is pacing the spending differently with a daily budget and lifetime budgets so having both in a comprehensive campaign gave Facebook more flexibility and ability to avoid auction overlaps since we run large marketing campaigns on the same audiences. We set up 90 days lifetime budgets and try to give enough daily budgets to the ad sets so it gets at least optimised for a day. In the ad set below we have 90 days X £1000 a day = £90 000 lifetime budget.

£1000 a day budget gave us around 80 sales a day, so even if we made a change in the ad set and lose its learning phase it will optimise again in a day. For that particular campaign we had half of all the LLAs split into daily and half into lifetime budgets.

Separating Feeds from Stories

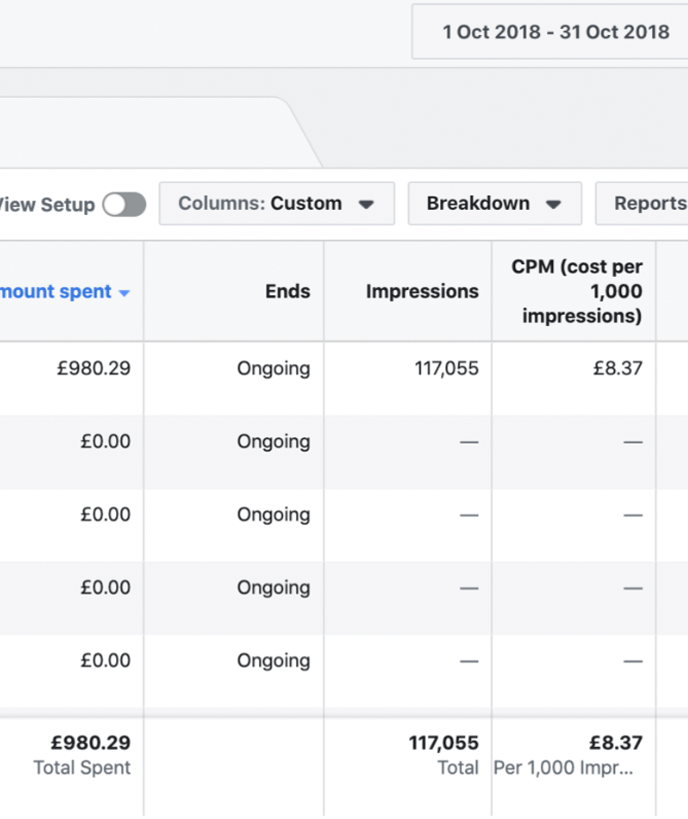

When we rolled out (scaled) the campaign one great way we did this was in as many placements as we could. Since we launched the initial ad sets into feed only then did we scale into Instagram and Facebook Stories. We prepared creatives optimised for these placements and we ran them to find the best preforming.

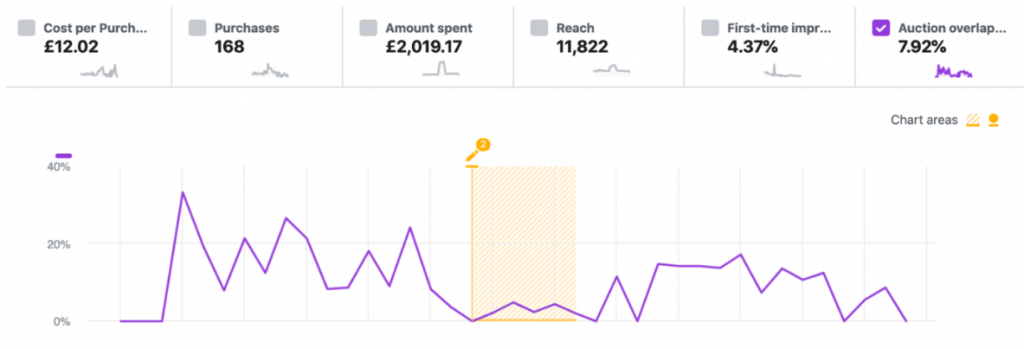

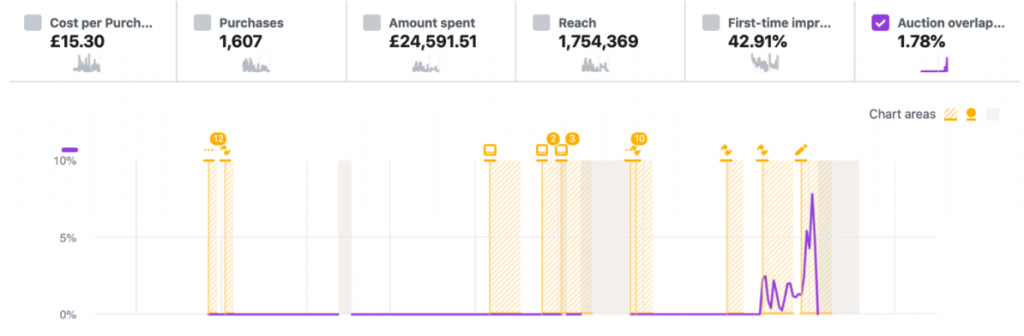

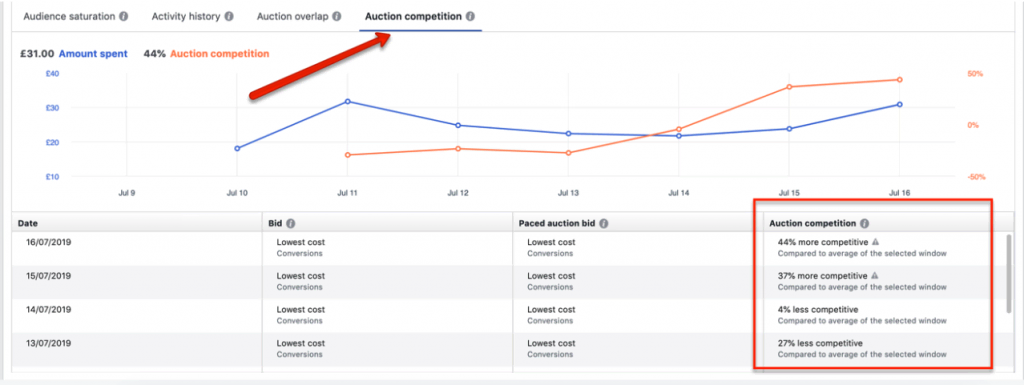

We will again be looking for the buyer’s pool and looking at auction overlap instead of audience overlap. If we see more then 20% auction overlap, then we start paying attention to the ad sets targeting the same audience and if necessary, we may pause some of them.

As you can see from the screenshots, we had very low auction overlap even though we run multiple LLAs with significantly high audiences overlap (sometimes 100% if we have duplicated the same ad set) without exclusions.

Manual bids and bid tests - the one-two punch 🥊

Having a campaign on automatic bids is limited. The reason is because of the competitive environment in the Facebook auction we can only reach a certain type of audience on automatic bids and even if we have a great creative that easily wins auctions there are many other competitors/advertisers with similar quality of creative but they use manual bids and bid higher in the auction to get better spots on the feed and hence better quality of traffic (people willing to buy now). This is why we always implement different manual bid strategies, so we make sure we reach the best audiences possible out there and leave no stone unturned.

In this particular case we were mostly doing manual bid tests and were scaling the campaign from the successful bid levels. We do manual bid test by creating 8 ad sets with different bid levels with the highest being 3-4X our desired CPA and lowest bid being the best CPA we are willing to get.

As the sales events in November and December worked so well the decision was made to carry these into the new year. Selling t-shirts over the winter period can be tricky so we felt having more regular promotions would help us combat this potential seasonality slump.

As a result of this decision and our media buying skills we were able to unlock some of the best revenue periods for this client.

Getting clear on the numbers

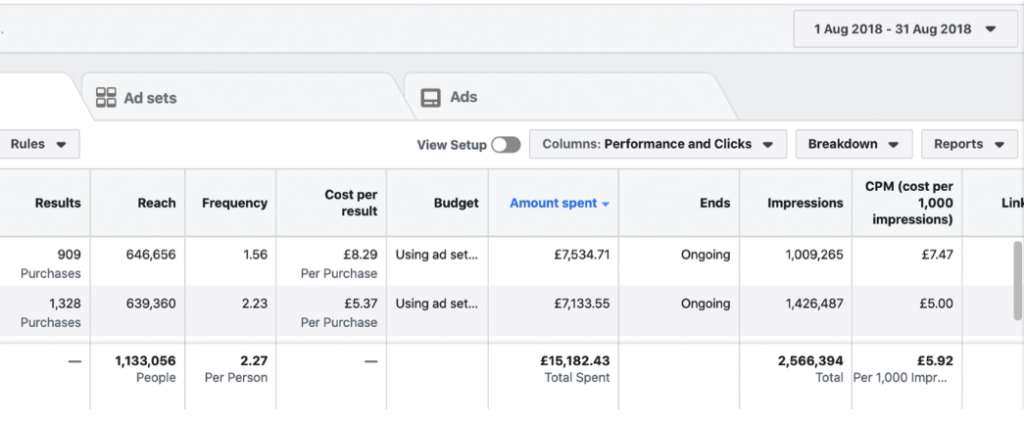

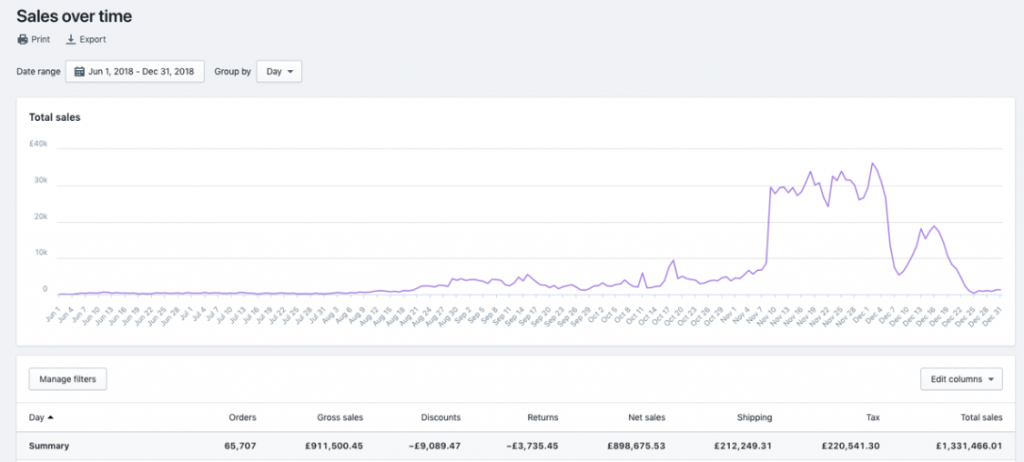

We started working with the account in August 2018. We spent £15,182.43 and we generated £44,190 in sales. As soon as we started pushing the budgets at a more significant rate, we started getting more organic sales through Shopify.

The organic sales were around 50% in Shopify and we had another 50% on Amazon.

People were tagging their friends which friends were also buying. This was not attributed in the ads manager, but we can see that clearly in the Shopify (snapshot). Since we were the only traffic channel for this business, we attributed 100% of the sales to the ad spend.

This correlation can also be seen the more we push in the next few months.

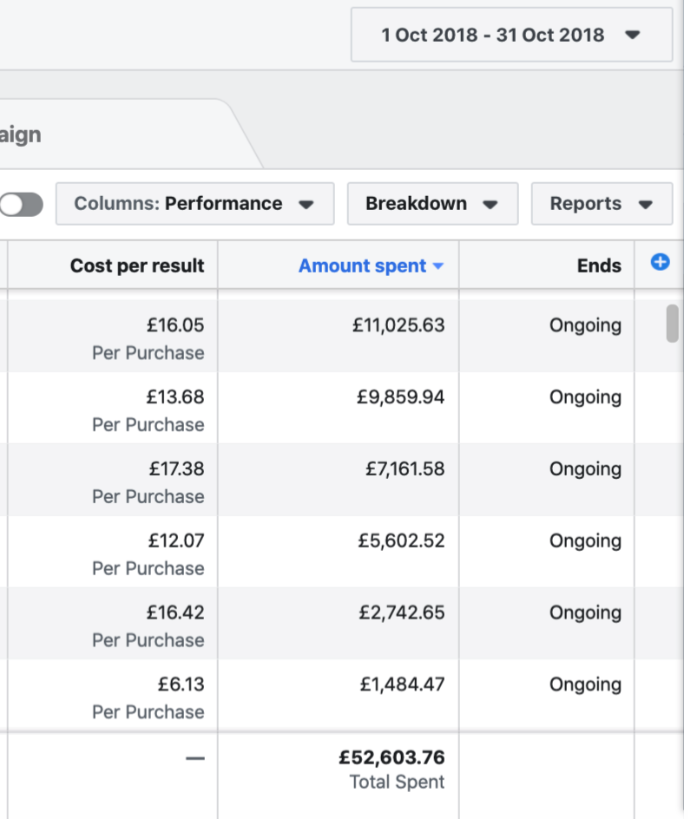

We used 3 ad account to scale their brand:

1 ad account dedicated to retargeting

2 ad accounts dedicated to prospecting

The reason we did this was because ad accounts get optimised to the event that happens most in them and if a CPA event is happening at a £7 (retargeting) level then we don’t want to dilute with a CPA happening at £15 (prospecting) because we expected high spend we did not want to contaminate the data in each account. This is a clever way of maximising the traffic and getting lower overall CPAs.

Throughout the entire campaign we optimised for purchase event only. We did not run any PPE, nor traffic or awareness campaigns.

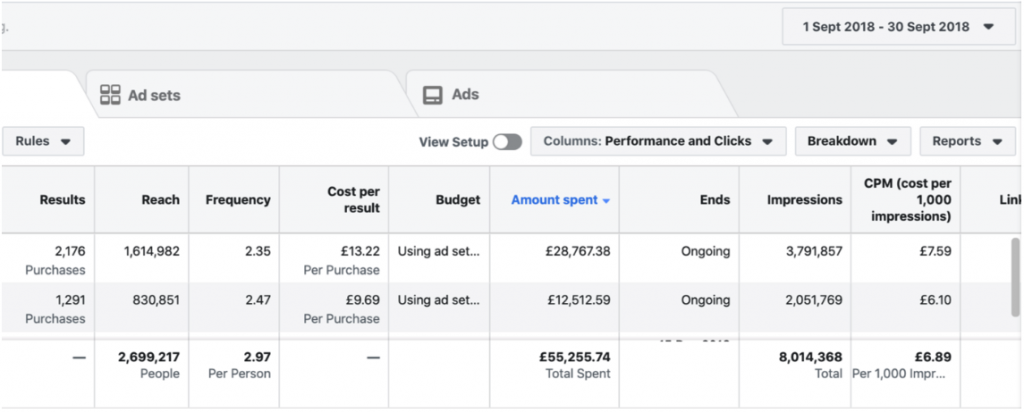

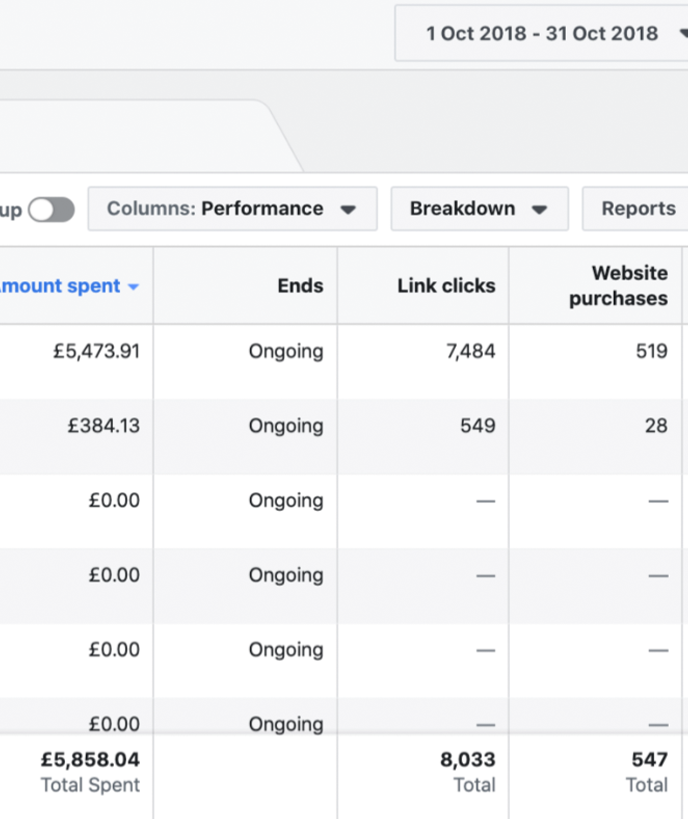

In September we already created new creative with the necessary direct response elements and structure and we started scaling the account. You can see the CPA doubled but was still in line with our target and given the organic sales generated (30-40%) we could afford higher CPAs and still be very profitable.

It’s important to note when you see an increased CPA and lower margin, it is important to consider that the number of sales multiplied by the (lower) margin gives a much higher overall profit then much less sales with higher margin.

You can again see that the purchases in the ads manager show only half (the organic sales) of the Shopify stats.

In September we spent £55k.

From August till October we were spending around £2k a day and the client was getting around £6k in revenue from Shopify and another £3k revenue from Amazon which made it profitable and sustainable and ROAS of 4.5.

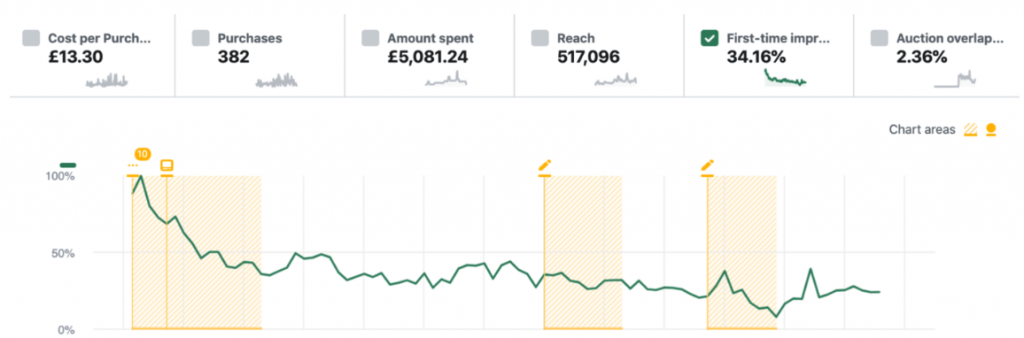

In September we experienced the first creative fatigue. Creative fatigue happens when the frequency gets too high and the first time impressions get too low.

In addition to the creative fatigue in August the client sold out and we just had to slow down.

In November we actually launched the additional ad account that was necessary for a larger spend given the reasons in the beginning and also given the daily FB ad spend limits.

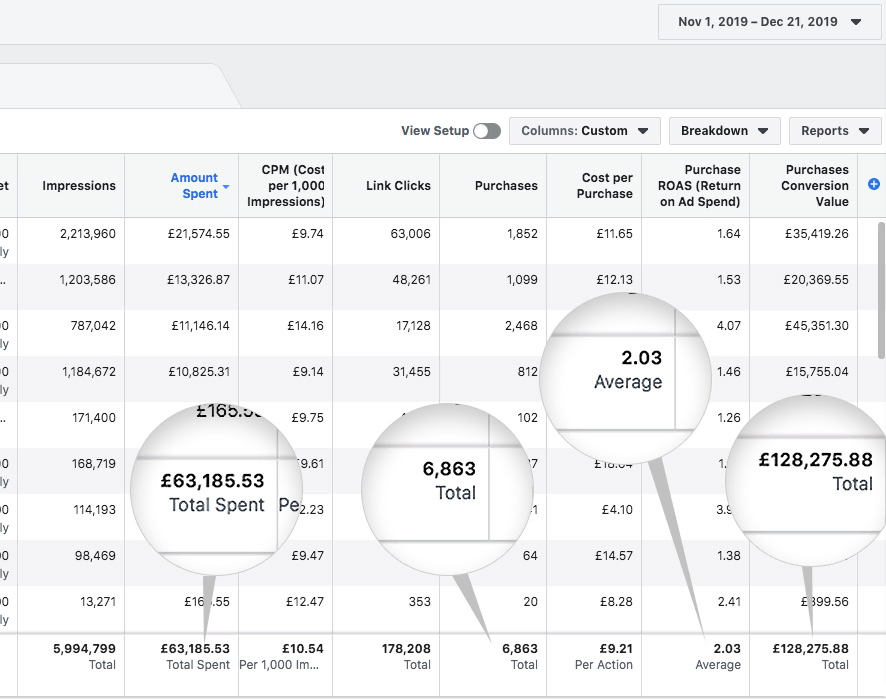

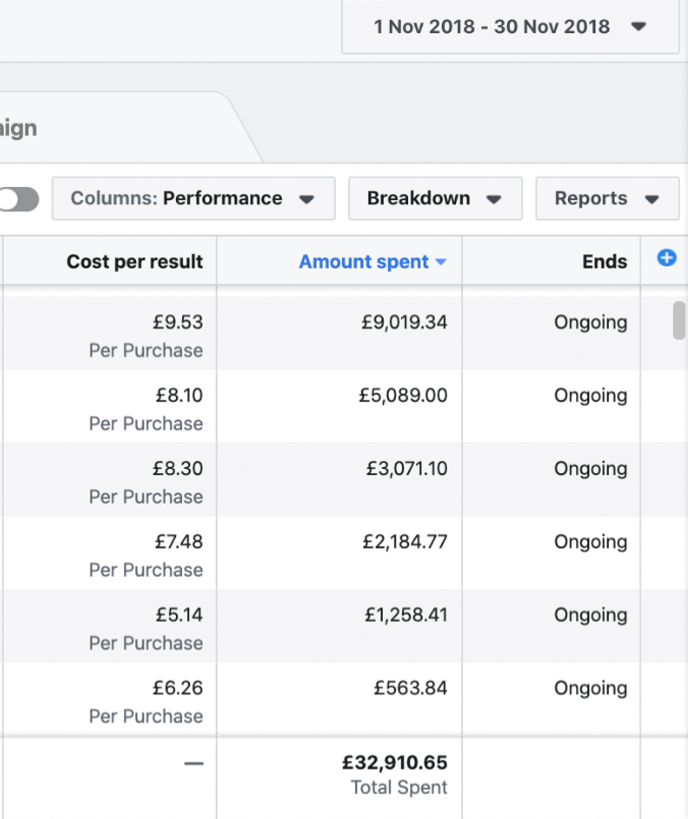

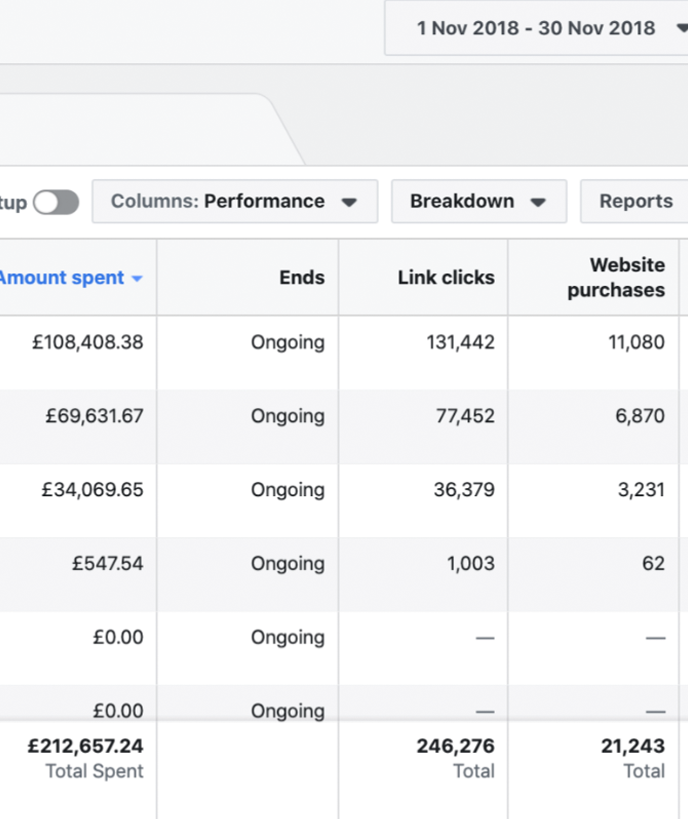

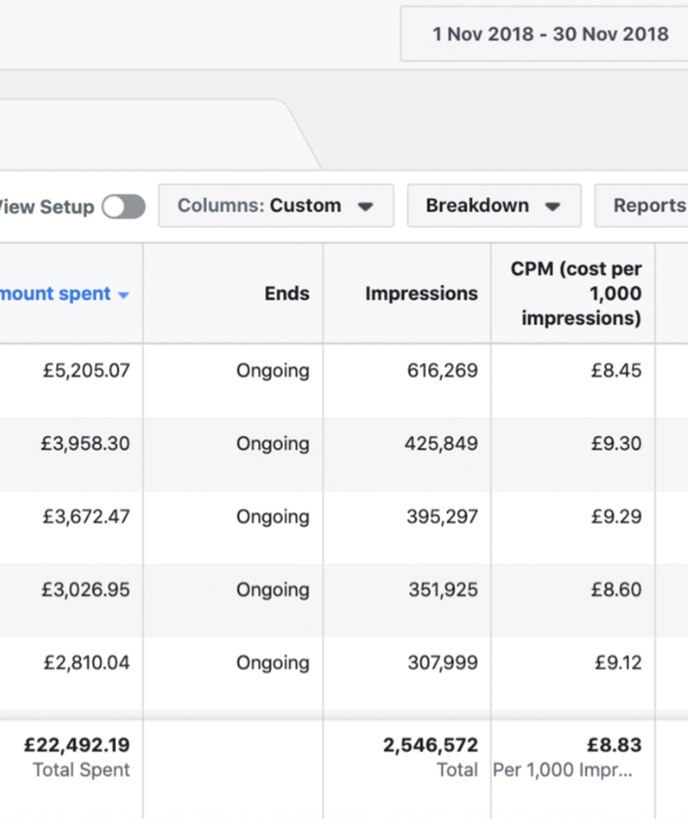

In November we spent £32,910.65 + £212,657.24 + £22,492.19 = £268,060.08

In November as well we started improving the website conversion rate again which was one of the main helpers of why we were able to scale so dramatically.

By improving and lengthening the product description and addition of social proof in the form of adding customer reviews we were able to achieve the conversion rate.

In December, given the huge amount of traffic, the client again sold out again.

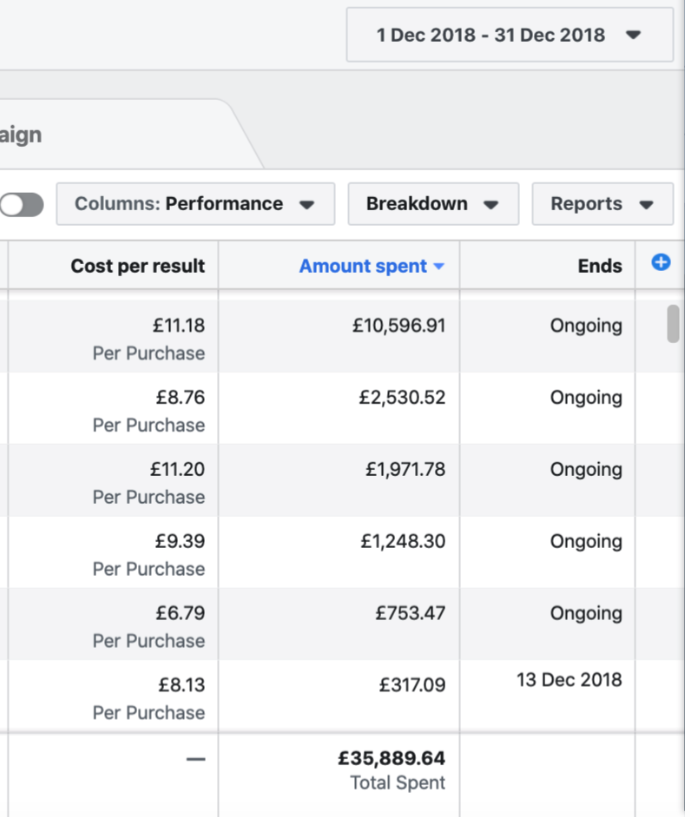

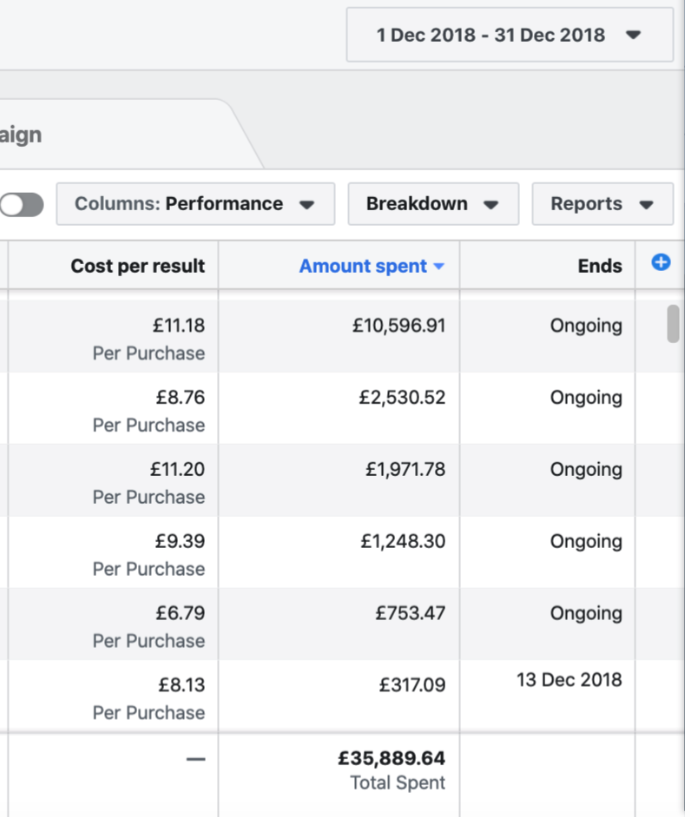

We spent £35,889.64 + £79,179.09 + £24,267.87 = 139,336.6.

We generated + £364 841,50 which is excluding amazon sales which are around 50% of the overall sales making the revenue around £700.000 and overall ROAS of 5.

In January we already sold out all stock for a month ahead and didn’t have any other choice but to slow down. The client felt they didn’t really want to push for sales in Jan given all the back log of sales they already had.

Overall, we generated around £1.6m in revenue for this client in Shopify and around £3m in revenue along with Amazon sales.

The brand is now well known in the UK since it had more then 80 million impressions.

Scaling Considerations

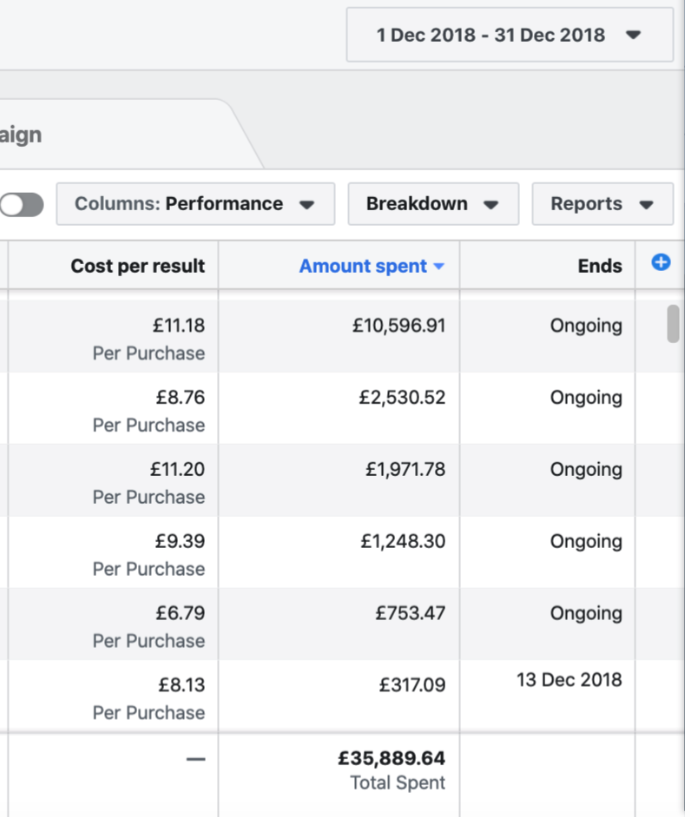

Each time we scaled and launched campaigns we launched at a strategic time taking into consideration ratios like, reach/purchases or spend/purchases as you can see from the screenshot below a certain period of the day (6am-12pm) it was much more desirable for launching and allowing optimisation of the campaign at lower CPA and higher CTRs making Facebook grade the advertisement higher and giving it a priority in the coming days.

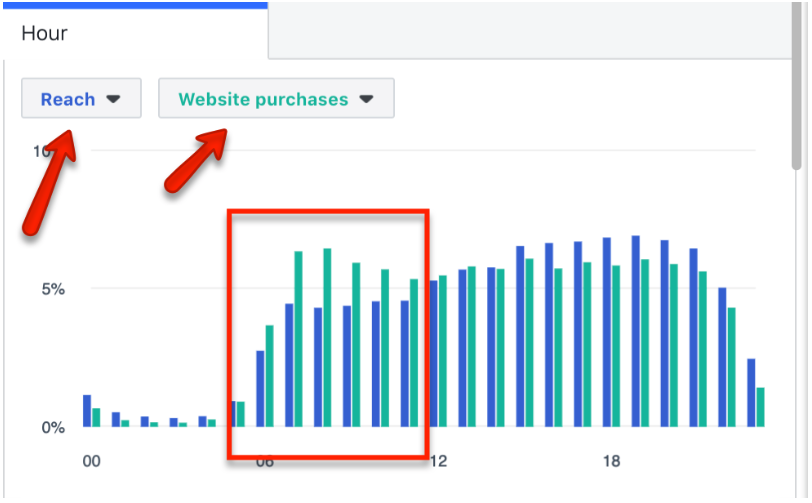

We took insight from delivery insight where we actually see auction demand and made decisions from there whether an ad set is not performing or its dip in performance is temporary given the high auction demand.

As you can see from the screenshot during the last 2 days demand has been rising which is the reason of declining CPAs and an indication that a manual bid strategy must be implemented in the high demand auction environment, thus we being more competitive instead of killing the automatic ad sets and calling it a ‘’failed campaign’’.

We also considered the auction overlap which is a better representation of an actual problem that may cause increase of CPA unlike the ‘’audience overlap’’ which other agencies and individual are actually focusing on. We know that there is a big performance difference between audience overlap and auction overlap.

Mentioning these two does not mean we have overlooked the other thousands of different angles and data points that guide us towards a successful and profitable implementation of Facebook and Instagram marketing campaign, however, given the limits of this paper we are pointing out only what we consider to be most misunderstood and not utilised correctly.

Conclusions and Learnings

We always experience stock issues and we try to prepare as much stock as possible before pushing a campaign.

Cashflow issues are prevalent when we spend high because of the delay of cash withdrawals from merchant accounts hence we look at cashflow before we push a campaign.

Creative fatigue always happens so we must have either a plan for future creatives or we must have built these prior to launching the campaigns.

Creative is critical for scaling large scaled campaigns as well as any campaign that we want to maintain for a longer period of time.

Website optimisation issues – a 1% increase in conversions may double your profits. It is crucial to have a website or a landing page that converts at its highest possible point before deciding to scale a campaign massively.

Proper backend preparation is required to scale to ensure high AOV and LTV. If we has more products and a really great post-purchase follow up process we could have 10X the results we had in this campaign.